- Get link

- Other Apps

The concept of money laundering is very important to be understood for those working within the financial sector. It is a process by which dirty cash is transformed into clear cash. The sources of the money in actual are legal and the cash is invested in a way that makes it seem like clear money and conceal the identity of the legal part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the new prospects or maintaining current clients the obligation of adopting adequate measures lie on each one who is a part of the organization. The identification of such ingredient in the beginning is easy to cope with as an alternative realizing and encountering such situations afterward within the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such situations.

A business that engages in multiple business activities may qualify for an exemption as a non-listed business as long as no more than 50 percent of gross revenues are derived from one or more of the ineligible business activities listed in the regulation24 FinCEN guidance states that. A non-listed business is defined as a commercial enterprise to the extent of its domestic operations and.

Bsa Aml Cip Ofac For New Accounts Ppt Video Online Download

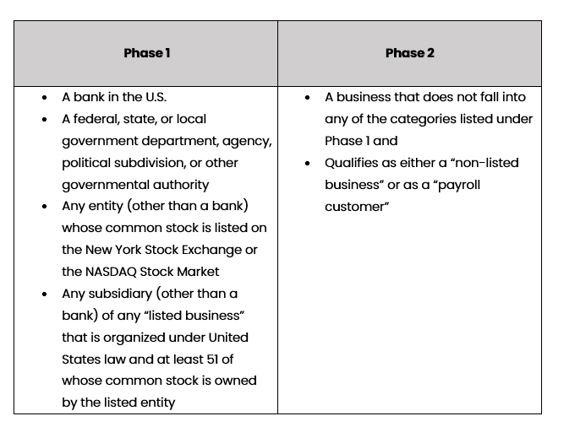

A business that does not fall into any of the Phase I categories may still be exempted under the Phase II exemptions if it qualifies as either a non-listed business or as a payroll customer.

Bank secrecy act non listed business. According to the Internal Revenue Service there is a general rule that any person. Non-listed businesses must 2 Bank is defined in The US. The BSA was designed to help.

A non-listed business is one that is not publicly traded on a major stock exchange. Bank Secrecy Act 12-04 81-2 DSC Risk Management Manual of Examination Policies. The law does not require every transaction exceeding 10000 to be documented.

All sections have. Department of the Treasury Treasury Regulation 31 CFR 10311. In order to be eligible for exemption the company must maintain a transaction account for two months have at least eight large currency transactions over a year and must be eligible to.

The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. 4265 Bank Secrecy Act History and Law Manual Transmittal. NCUA monitors credit unions for compliance with the.

To be compliant with BSA requirements banks should also monitor transactions for Non-Bank Financial Institution NBFI and Money Services Business MSB customers. How the Bank Secrecy Act Works. Bank Secrecy Act BSA High-Risk Entities.

Non-Listed Businesses cont Some businesses are ineligible to be exempt as Non-Listed Businesses Ineligible businesses are defined as businesses engaging in any of the following activities. A non-listed business is defined as an enterprise that. A business engaged in marijuana-related activity may not be treated as a non-listed business under 31 CFR 1020315e8 and therefore is not eligible for consideration for an exemption with respect to a banks CTR obligations.

BSA Related Regulations. Material Changes 1 IRM 42651 Program Scope and Objectives added to comply with IRM 111225 Address Management and Internal Controls. Before treating a non-listed business or payroll customer as exempt a bank must first determine that the customer has conducted five or more transactions within the previous year has been a customer of the bank for at least two months or less time on a risk-assessed basis and in the case of non-listed businesses derives no more than 50 of its gross revenues from any ineligible business activity.

A business that engages in multiple business activities may qualify for an exemption as a non-listed business as long as no more than 50 percent of gross revenues are derived from one or more of the ineligible business activities listed. The legislations formal name is The Financial Record Keeping and Reporting of Currency and Foreign Transactions Act of 1970. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report.

BANK SECRECY ACT OVERVIEW Overview Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. Serving as a financial institution or as agents for a financial institution of any type. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Purpose 1 This transmits revised text for IRM 4265 Bank Secrecy Act Bank Secrecy Act History and Law. 3 is incorporated or organized under the laws of the United States or a state or is registered.

Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. I has maintained a transaction account at the bank for at least 12 months ii frequently engages in transactions in currency in excess of 10000 and iii does business in the United States.

The BSA was amended to incorporate the. Transactions of Exempt Persons Phase II CTR Exemptions 4 Under Phase II exemptions there are two other categories of customers certain non-listed businesses a This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. Eligible Non-Listed business A business which 1 has had a transaction account at the credit union for at least 12 months.

2 frequently engages in currency transactions greater than 10000. Before treating a non-listed business customer as exempt a bank must first determine that the customer has conducted five or more transactions within the previous year has been a customer of the bank for at least two months or less time on a risk-assessed basis and derives no more than 50 of its gross revenues from any ineligible business activity. Commercial enterprises non-listed businesses that have maintained transaction accounts at the bank for at least 2 months 5 or more cash transactions in a 12 month period registered and eligible to do business in the United States not engaged in a business that is on the list of ineligible business.

Reflect what a business actually earns from an activity conducted by the business rather than the sales volume of such activity. Cash-intensive businesses such as convenience stores restaurants retail stores and parking garages.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Bank Secrecy Act Workshop Bsa Aml Training For Banks

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Understanding Ctr Exemptions And Their Practicality

Facebook Announces Libra Cryptocurrency All You Need To Know Techcrunch Bank Secrecy Act Cryptocurrency Testimony

![]()

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Bankers Compliance Training The Bank Secrecy Act Bsa

Iraqi Dinar Coa Certificate Of Authenticity From Worldwide Collectibles Llc Www Buyiraqidinarhere Com Dinar Iraqidinar Dinar Iraqi Certificate

10 Fast Facts About The Bank Secrecy Act

Am I An Msb Nizari Credit Union

The world of laws can seem to be a bowl of alphabet soup at instances. US cash laundering regulations aren't any exception. We've got compiled a listing of the top ten money laundering acronyms and their definitions. TMP Risk is consulting agency focused on protecting financial services by lowering danger, fraud and losses. We have large bank experience in operational and regulatory danger. We have now a powerful background in program administration, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many hostile consequences to the organization because of the dangers it presents. It will increase the chance of major dangers and the opportunity cost of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment